What Is a Fork in Cryptocurrency?

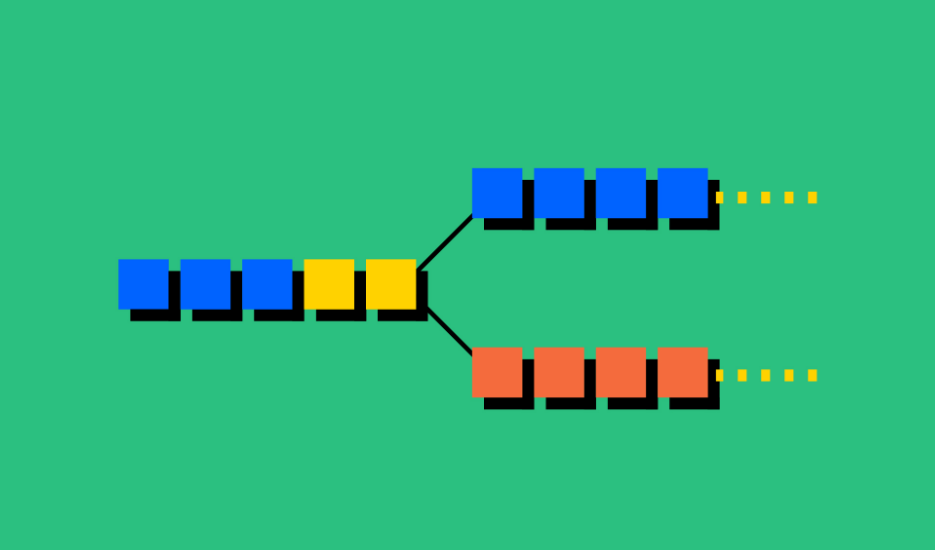

In the world of cryptocurrency, the term “fork” is commonly used, but it can be confusing for beginners. A fork occurs when a blockchain network splits into two separate chains, creating two versions of the blockchain. Forks can happen for various reasons, including updates to the protocol, disagreements among developers or the community, or to introduce new features. Understanding forks is essential for anyone involved in cryptocurrency, as they can impact transactions, investments, and network security.

How Forks Happen in Blockchain

A blockchain is a continuous ledger of blocks containing transactions. All nodes in the network follow the same rules, known as the consensus protocol, to validate transactions and maintain the chain. A fork occurs when there is a change or disagreement in these rules, resulting in two possible outcomes:

- The blockchain continues with the new rules, leaving the old chain behind.

- Two separate chains coexist, each following different rules.

Forks can be temporary or permanent, depending on the type and purpose.

Types of Forks in Cryptocurrency

Forks are generally categorized into two main types: soft forks and hard forks.

1. Soft Fork

A soft fork is a backward-compatible update to the blockchain protocol.

- It allows upgraded nodes to recognize transactions from older versions of the software.

- The old nodes still accept new blocks, but may not utilize the new features.

- Soft forks are often used to implement minor improvements, enhance security, or optimize efficiency without splitting the network.

Example: The implementation of Segregated Witness (SegWit) in Bitcoin was a soft fork designed to improve transaction capacity and reduce fees.

2. Hard Fork

A hard fork is a permanent, non-backward-compatible change in the blockchain rules.

- Nodes that do not upgrade to the new protocol will no longer accept blocks created under the new rules.

- Hard forks often result in two separate blockchains, each with its own version of the cryptocurrency.

- They can occur due to disagreements in the community, major upgrades, or to introduce entirely new features.

Example: Bitcoin Cash emerged as a hard fork from Bitcoin to address scalability and transaction speed concerns.

Reasons for Forks

Forks can happen for various reasons, including:

- Protocol Upgrades: To improve scalability, security, or transaction efficiency.

- Disagreements Among Developers: Conflicts over the direction of the project or governance decisions.

- Adding New Features: Introducing smart contracts, privacy enhancements, or other functionalities.

- Fixing Security Issues: Correcting vulnerabilities or bugs in the blockchain code.

Effects of a Fork

Forks can have several effects on the cryptocurrency ecosystem:

- New Coins: Hard forks can create new cryptocurrencies, giving holders coins on both chains.

- Market Volatility: Forks often lead to price fluctuations as traders respond to uncertainty.

- Community Division: Disagreements can split the community, affecting developer support and adoption.

- Enhanced Features: Upgrades from forks can improve transaction speed, security, and scalability.

How Investors Should Respond

Investors should approach forks carefully:

- Stay Informed: Understand the purpose and type of fork before taking any action.

- Secure Wallets: Ensure cryptocurrencies are stored in wallets that support the forked coins.

- Plan Investments: Forks can affect the value of cryptocurrencies; consider potential risks and rewards.

- Follow Updates: Keep track of official announcements from developers and exchanges.

Conclusion

A fork in cryptocurrency is a fundamental mechanism that allows blockchain networks to evolve, upgrade, or resolve disagreements. Whether it is a soft fork, which is backward-compatible, or a hard fork, which creates a permanent split, understanding forks is crucial for anyone using, investing, or developing in the cryptocurrency space.

Forks can present both opportunities and challenges, impacting network functionality, market prices, and investor strategies. Staying informed and prepared helps navigate the complex but dynamic world of blockchain forks effectively.