How Stablecoins Relate to Bitcoin and Ethereum

In the rapidly evolving world of cryptocurrency, stablecoins have emerged as a key component of the digital asset ecosystem. Unlike Bitcoin or Ethereum, which are known for their price volatility, stablecoins are designed to maintain a stable value, typically pegged to a fiat currency like the U.S. dollar. Understanding how stablecoins relate to major cryptocurrencies like Bitcoin and Ethereum is essential for investors, traders, and anyone participating in the crypto market.

What Are Stablecoins?

Stablecoins are digital currencies that aim to combine the advantages of cryptocurrencies—such as fast transactions, decentralized control, and accessibility—with the stability of traditional money. They maintain their value by being backed by:

- Fiat reserves: The stablecoin is pegged 1:1 to a fiat currency held in reserve.

- Cryptocurrency collateral: The stablecoin is backed by other cryptocurrencies held in smart contracts.

- Algorithmic mechanisms: Supply and demand algorithms help maintain the peg without direct backing.

Popular stablecoins include Tether (USDT), USD Coin (USDC), and Dai (DAI).

See also: Impact of Technology on Communication

Relationship Between Stablecoins and Bitcoin

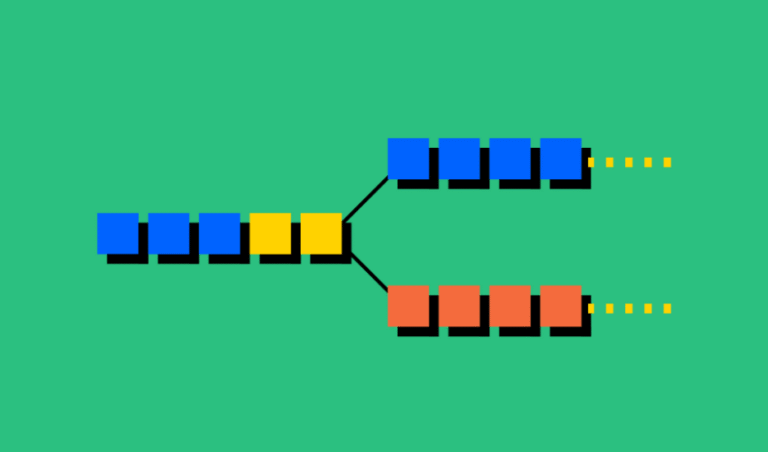

Bitcoin was the first cryptocurrency and is primarily used as a store of value and investment asset. However, its high volatility can make it challenging for daily transactions or as a medium of exchange. This is where stablecoins come into play:

- Hedging Against Volatility: Traders and investors often convert Bitcoin into stablecoins during market downturns to preserve value without leaving the cryptocurrency ecosystem.

- Liquidity in Exchanges: Stablecoins provide liquidity for Bitcoin trading pairs, making it easier to buy or sell Bitcoin quickly.

- Gateway for Investment: Stablecoins allow new investors to enter the crypto market without directly purchasing volatile assets like Bitcoin.

In essence, stablecoins act as a bridge for Bitcoin users, providing stability while keeping funds within the blockchain ecosystem.

Relationship Between Stablecoins and Ethereum

Ethereum is more than a cryptocurrency; it is a platform for decentralized applications (dApps) and smart contracts. Stablecoins are closely linked to Ethereum in several ways:

- Token Standards: Many stablecoins, including USDC and DAI, are issued as ERC-20 tokens on the Ethereum blockchain, meaning they follow Ethereum’s token standards.

- DeFi Integration: Stablecoins are widely used in Ethereum’s decentralized finance (DeFi) ecosystem for lending, borrowing, and yield farming. Their stability makes them ideal for smart contracts that require predictable values.

- Collateral for Loans: Ethereum users can lock ETH in smart contracts to mint stablecoins like DAI, providing liquidity while retaining exposure to Ethereum’s growth.

Ethereum’s infrastructure enables stablecoins to function efficiently, integrate with DeFi applications, and expand the use of digital assets beyond simple transfers.

Benefits of Stablecoins in Relation to Bitcoin and Ethereum

- Reduced Volatility Risk: Investors can protect their funds during extreme market fluctuations in Bitcoin or Ethereum.

- Efficient Transactions: Stablecoins allow fast, low-cost transfers compared to traditional banking, especially when paired with Ethereum smart contracts.

- Liquidity and Trading: They facilitate smoother trading of Bitcoin and Ethereum on cryptocurrency exchanges.

- DeFi Functionality: Stablecoins enable lending, borrowing, and yield generation on Ethereum-based decentralized platforms.

- Global Accessibility: They provide a stable digital currency for users in countries with volatile local currencies.

Challenges and Considerations

While stablecoins offer significant advantages, there are challenges:

- Centralization Risks: Some stablecoins rely on centralized entities to hold fiat reserves, which introduces counterparty risk.

- Regulatory Scrutiny: Governments are increasingly monitoring stablecoins for compliance and financial stability concerns.

- Peg Stability: Algorithmic stablecoins may lose their peg during extreme market events, as seen with some past projects.

Conclusion

Stablecoins play a critical role in the cryptocurrency ecosystem by complementing the functionalities of both Bitcoin and Ethereum. For Bitcoin, they provide stability and liquidity for trading and investment purposes. For Ethereum, they enable efficient integration with smart contracts, decentralized finance, and tokenized ecosystems.

By bridging the gap between volatile cryptocurrencies and traditional currency stability, stablecoins enhance usability, adoption, and flexibility within the crypto market. Understanding their relationship with major cryptocurrencies like Bitcoin and Ethereum is essential for anyone looking to navigate the digital asset landscape effectively.